|

|

|

|

|

In the never ending battle against urban natural gas exploration and production new battle lines are being drawn as opponents of urban drilling gain their sea legs and figure out what strategies work and which ones are better left behind. FracDallas has long contended that the most effective arguments are those based in law and economics because those are the predicates upon which most municipal decisions rest.

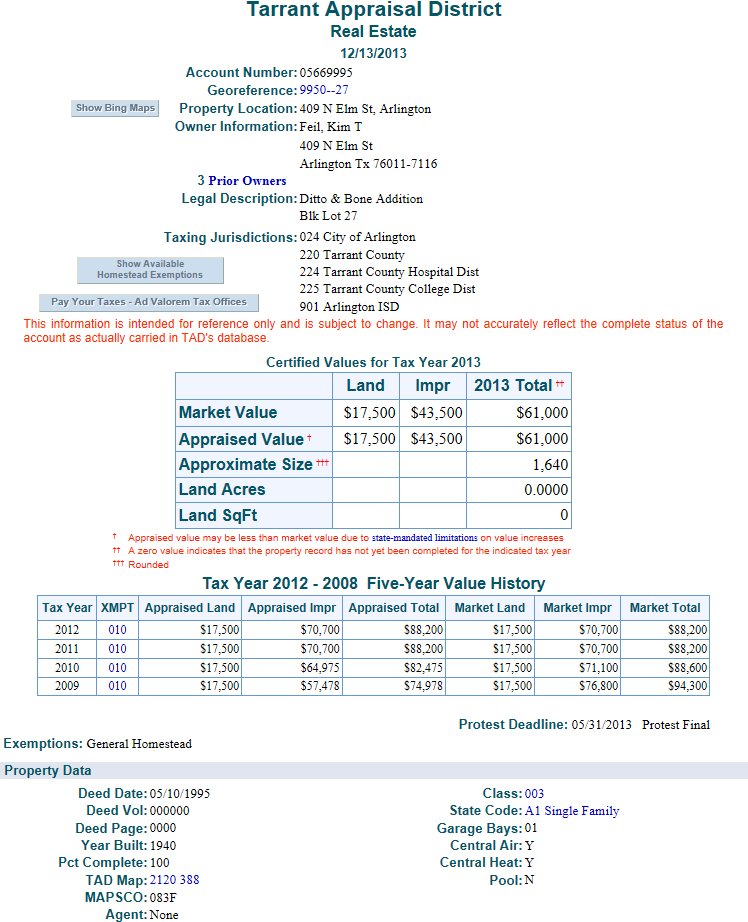

Locally, cities are looking at gas drilling as a way to fill budget holes without raising local taxes or cutting services to the communities they serve. It is easy money, or at least it was easy money. For a fact, revenues from natural gas production are a pittance of what they were just five years ago and the situation is not improving. The glut of natural gas is keeping market prices suppressed, and fields that were once repleat with an abundance of gas are depleting at a rapid rate due to overproduction because producers amassed tremendous debt and need to keep drilling to meet the service (interest payments) on that debt. Cities and counties rely upon tax revenues for income to pay for critical services like police, fire, sanitation, roads, healthcare, parks and education. The higher the tax base the more money is available to fund projects that require substantial investment in communities with ever-growing populations and demands for more services. So, what happens when the tax base declines? The obvious answer is that some services are reduced, some services are cut and taxes have to be increased to make up for the losses. But, nobody wants to raise taxes, yet the quality of services is the magnet that draws people and businesses to an area without which there are fewer jobs and a declining community environment. Detroit, Michigan is a typical example of what happens when industry leaves taking with it jobs and the economic engine that spurred developemnt and growth. Fewer jobs means less money in the market resulting in rental vacancies, foreclosures of homes and business properties, declining county tax revenues and an eventual exodus of residents and small businesses that serve residents and larger businesses. Recently, a new strategy has emerged that has a lot of merit, and which has the potential to send shockwaves throughout municipal and county governments because it strikes at the very core of government revenues. Many homeowners living near natural gas operations have suffered severe reductions in their property values due to their close proximity to hazardous industrial activities that endange human health and safety, reduce quality of life and damage the environment, all of which make living there much less attractive and thus reduce the amount of money people are willing to pay for properties where they and their families may be harmed in ways that threaten to shorten their lives and cost them substantially more money in healthcare costs for which they have little or no insurance. One such example of this reduction is property values was recently demonstrated by Arlington, Texas resident Kim Feil, who lives very close to natural gas wells, transmission and distribution pipelines, compressor stations and other natural gas infrastructure resulting in major adverse health effects on she and her family. Exposure to air and water toxins makes living near such heavy industrial activity untennable, and if one person has to move because of exposure, then other people are not going to want to come into that area and buy homes where they and their families would suffer the same exposure risks. Ms. Feil recently appealed her annual county propety tax valuation and won a reduction of 31% on the tax base value of her home. See Ms. Feil's Tarrant Appraisal District (TAD) report below:  But, individual homeowners are not the only ones getting property value reductions from appraisal districts. Apparently, companies involved in the producion or processing of natural gas are also having their asset value eroded by their own operations leading to devaluations at the Tarrant Appraisal District. TAD record #04083962 has a drill site on the property (near Bowie High School) and is coded as having farmland/agricultural exemption status. The tax value over the last 5 years has dropped 16%, where as Texas Instruments in the area has grown one half of a percent. And, even where there is no padsite land that is owned by DFW Midstreams, a compressor station facility in Arlington (TAD #07899017), is coded as undeveloped/commerical/vacant and has received a 25% tax relief on property value loss. These numbers reflect the effects that gas drilling can and will have on the asset value of real estate due to the hazard risks that exist by virtue of their close proximity to production, refining, compression or pipeline infrastructure. As more people begin to seek reconsideration of their asset value by requesting a tax re-appraisal, and such reductions in value are granted as they were in the three cases cited above, the county and the cities which draw money from county taxes will begin to face massive budget shortfalls that far more than offset any revenues generated by taxes and royalties on gas production resulting in curtailment of civil services. As services are cut or suspended businesses will shutter their doors and jobs will be lost resulting in home, retail and commercial foreclosures and an exodus of citizens chasing jobs to sustain their livelihoods. This scenario is already manifesting itself in part of the Bakken Shale where small towns ramped up with additional motels and apartments, restaurants, convenience stores and other businesses necessary to service the growing population of immigrant workers moving in with the oil and gas rigs, and then leaving as field depletion occurs or build-out is completed and they move on to the next area. Suddenly, many new hires to service those workers are terminated resulting in residential vacancies for properties that are encumbered with loan debt that eventually takes a toll on the lending institutions themselves. A strategy shift needs to take place in the form of residents and business owners asking for reductions in their tax valuation based upon their close proximity to natural gas infrastructure and operations. If significant numbers of residents request and receive property value reductions, then the amount of tax revenues collected by the county will be much lower leaving cities and counties scrambling to make up the lost revenues with no viable alternative. Those cities and counties that forecast future budget requirement revenues from taxes and royalties will soon find huge holes in their revenue stream that cannot be filled forcing them to reassess which services will be suspended and which services will be curtailed in order to prevent the city or county from having to acquire more debt to stay afloat. Such a strategy by residents and businesses would compel civic leaders to take another look at the supposed benefits of urban gas production and come to the realization that very short term gain was not worth the long term damage. Following typical trends, it would lead to those making the decisions to promote gas production departing their jobs, which would then be filled by people who would look for other answers that would restore municipal viability and attraction. Kim Feil has a blogsite titled Barnett Shale Hell that provides substantial detail and information about this issue of declining property values caused by shale gas production in Arlington, Texas, which is home to some 60 padsites and many more wells, compressor stations, pipelines, gathering stations, metering stations and other hazardous infrastructure that is transforming a once thriving and attractive entertainment center into an industrial wasteland on the false promises of eternal riches from shale gas production in a densely populated urban area. Contact Ms. Feil through her blogsite to find out what you can do to get a more accurate tax appraisal and tax reduction on your property that is located close to drilling sites and other natural gas infrastructure. For another perspective on this issue please visit the DARRD website. |